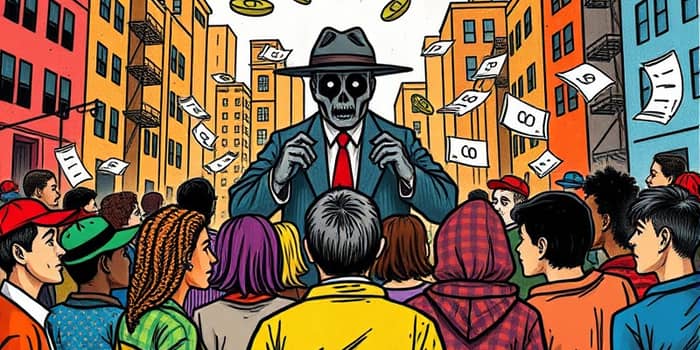

Predatory lending undermines trust in the financial system and preys on those least able to defend themselves. This article delves into its mechanisms, impacts, and the ethical imperative for reform.

At its core, predatory lending involves unfair, deceptive, fraudulent or abusive loan practices. Lenders may impose ultra-high interest rates, hidden fees, and confusing repayment schedules designed to trap borrowers in never-ending debt.

Typical elements include:

Lenders employ sophisticated strategies to maximize profits at the borrower’s expense. Understanding these gives consumers and regulators tools to fight back.

Predatory lending disproportionately affects low-income and minority communities. Many live in “bank deserts” where traditional financial services are scarce, forcing them into alternative, high-cost options.

In the United States in 2022 alone, payday lenders extracted $2.4 billion in fees. Texas led with $1.3 billion, California followed with $224 million, and Florida with $252 million. Online lending’s share soared from 25% to 49% in California and 55% to 57% in Alaska between 2019 and 2022.

Predatory lending raises profound moral questions about fairness, exploitation, and the role of finance in society. Key issues include:

Debates rage between consumer advocates pushing for strict rate caps and industry defenders who argue that small-dollar loans serve as a vital emergency credit source. A middle-ground perspective calls for fair, regulated products rather than outright bans.

The current landscape is a patchwork of state and federal laws. Over 20 states and Washington, D.C., cap interest rates at 36% APR, while others permit rates in the hundreds of percent.

Key regulatory strategies include:

Despite these measures, loopholes persist. Online and app-based lenders increasingly partner with out-of-state banks to sidestep local caps, highlighting the need for a federal interest rate limit and stronger enforcement.

Ending predatory lending demands a multipronged approach. Policy reforms, industry self-regulation, and community education must work in tandem to protect consumers.

Key recommendations include:

By recognizing predatory lending as not just a financial issue but a moral crisis, stakeholders can build a more just system where credit serves empowerment, not exploitation.

References