From the barter networks of prehistory to the globalized energy markets of today, humanity has navigated a profound journey. This evolution reflects our collective ingenuity and the relentless drive to transform scarcity into prosperity.

Long before coins or standardized currency, materials like obsidian and flint served as valuable tools and trade goods. Archaeological finds date formal exchanges back over 150,000 years, demonstratingearly humans’ complex social interactions.

With the advent of agriculture around 10,000 BCE, societies began to generate surpluses, enabling specialization. Clay tokens in ancient Mesopotamia and trade along the Tigris-Euphrates and Nile rivers laid the groundwork for formal markets and long-distance exchange.

The transition from local subsistence to global trade gained momentum through successive agricultural revolutions. Each wave delivered breakthroughs in productivity and distribution.

As production rose, farmers tapped into distant markets, knitting regional economies into a nascent global network and aligning agriculture with capitalist incentives.

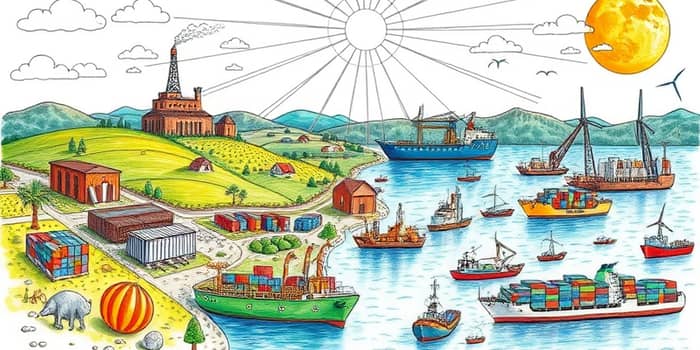

The Industrial Revolution intensified demand for raw materials and energy. Coal became the lifeblood of factories, and consumption surged by 50% between 2000 and 2008, fueled by rapid industrialization in Asia.

Oil transformed transportation and industry. Global output climbed from about one million barrels per day in 1920 to nearly one hundred million barrels per day by 2019. Early dominance by the Seven Sisters cartel gave way to OPEC and eventually to market-driven pricing after the 1970s oil shocks.

Natural gas and renewable sources later complemented coal and oil. Between 2000 and 2010 renewables grew slowly, but from 2010 to 2020, policy incentives and cost reductions accelerated their market share.

Beyond production, new institutions and mechanisms stabilized prices and reduced risk. Futures trading emerged in 17th-century Japan for rice, followed by grain contracts in Chicago in 1848. These tools introduced price risk management and market stability for producers and consumers alike.

Quantitative milestones illustrate the scale of this transformation. Oil production’s hundredfold increase, cereal yields’ doubling from 1960 to 2000, and coal trade volumes’ rapid expansion between 1970 and 1990 reflect unprecedented capacity to meet demand.

Today, emerging markets contribute a growing share of both demand and supply. Innovations like shale drilling and offshore extraction underscore rapid technological breakthroughs in extraction. At the same time, renewable energy technologies have reached cost parity, reshaping the energy mix.

However, abundance carries new risks. Overconsumption strains ecosystems, and climate change demands a shift toward circular economies and sustainable sourcing. Inequalities persist as benefits of low-cost resources are unevenly distributed, provoking debates over labor standards, resource sovereignty, and ethical trade practices.

Looking ahead, resource markets will be defined by balancing supply potential with environmental stewardship. Smart grids, carbon pricing, and green finance offer pathways to environmental and social constraints ahead. The evolution continues as humanity strives not just for abundance, but for responsible abundance.

From the humble barter of obsidian in prehistoric times to the complex, data-driven markets of the digital era, the story of resources is one of adaptability and innovation. Understanding this history equips us to navigate future challenges and to craft a world where abundance aligns with sustainability and equity.

References